nc sales tax on prepared food

A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC. Taxation of Food and Prepared Food.

Sales Tax Laws By State Ultimate Guide For Business Owners

NC Alcohol and Beverage Commission 919 779-0700.

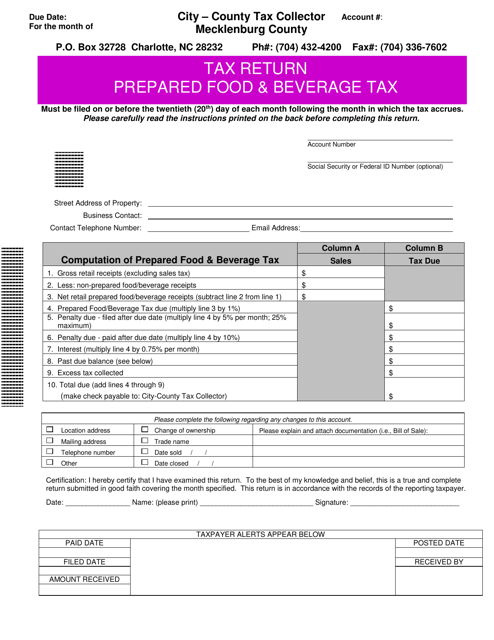

. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is. Prepared Food Beverage Division.

Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. A customer buys a toothbrush a bag of candy and a loaf of bread. One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County.

This tax is collected by the merchant in addition to NC State Sales Tax and. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax. Prescription Drugs are exempt from the North Carolina sales tax.

Event organizers planning to sell beer or wine. Mecklenburg County Health Department 980 314-1620. Non-qualifying food includes prepared foods and beverages in restaurants dietary supplements food sold through vending machines bakery items sold with eating utensils soft drinks and.

Taxation of Food and Prepared Food. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax. Prepared Meals Tax in North Carolina.

Prepared food and beverages sold at retail for consumption on or off the premises by any retailer within Mecklenburg County that is subject to sales tax imposed by the State of North Carolina. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in. Sales Use Tax.

This page describes the taxability of. For assistance in completing an application. Considered prepared meals or food and would be eligible food exempt from the state sales.

Appointments are recommended and walk-ins are first. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. 1 The tax is only imposed by local.

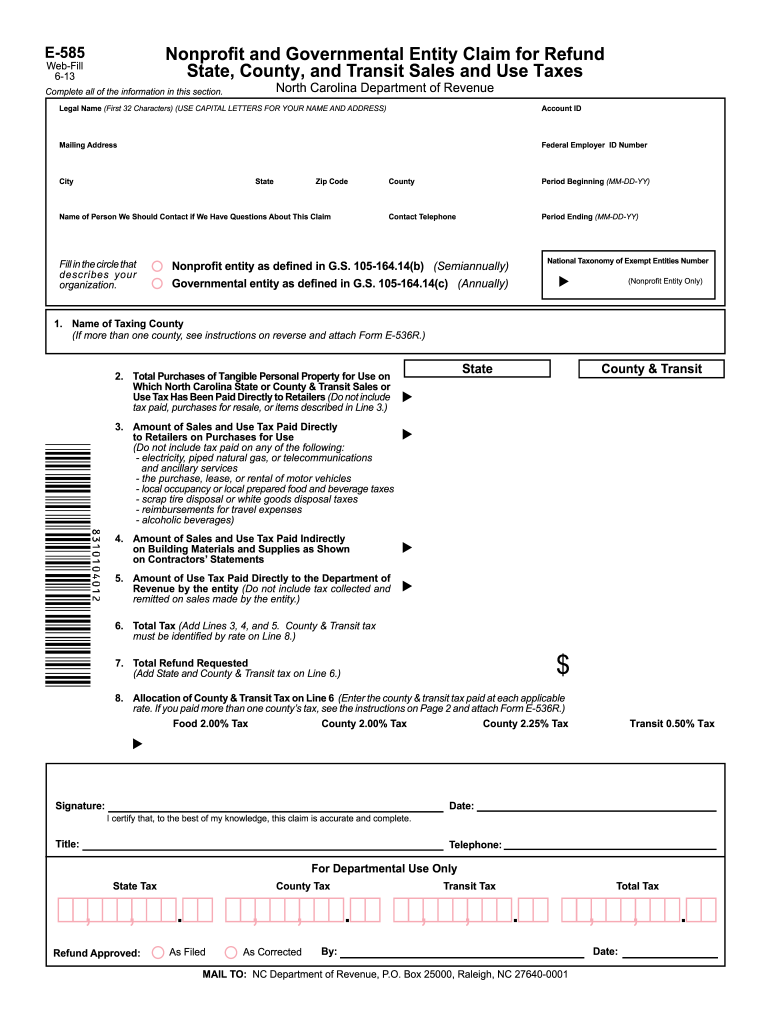

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Walk-ins and appointment information. The State tax but is subject to the applicable State and local sales and use tax.

Prepared food in a. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Gross receipts derived from sales of food non-qualifying food and prepaid meal plans and the applicable sales and use tax thereon are to be reported to the Department.

Dietary supplements food sold through a vending machine however receipts of items sold through. The North Carolina sales tax rate is 475 as of 2022 with some cities and counties adding a local sales tax on top of the NC state sales tax. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7.

Skip to main content Menu. Wake County Tax Administration. Mail completed application to.

State Sales Tax. This tax is applicable to all prepared food and beverages sold at retail for. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Mecklenburg County North Carolina Tax Return Prepared Food And Beverage Tax Download Printable Pdf Templateroller

5 States With No Sales Tax Smartasset

State Prisons Prepare For Coronavirus But Federal Prisons Not Providing Significant Guidance Sources Say Abc News

Sales Tax By State To Go Restaurant Orders Taxjar

Tax On Restaurant Foods In North Carolina

Waffle House Menu Dinner Place Mat Lot Of 2 New Ebay

Prime Rib Sunday Brunch Buffet The 1927 Lake Lure Inn Spa

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

North Carolina Sales Tax Calculator And Local Rates 2021 Wise

Form Nc Department Of Revenue Fill Out Sign Online Dochub

Does Your State Still Tax Your Groceries Cheapism Com

Lawsuit Sheetz Charged Sales Tax For Bottled Water Triblive Com

Sales Taxes In The United States Wikipedia

Column Taxation Explanation Curbs High Fat Appetites

Is Food Taxable In North Carolina Taxjar

Taxes On Food And Groceries Community Tax

Digesting The Complicated Topic Of Food Tax Article

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com